Sign up with PbN ZeroPay.

- Solutions

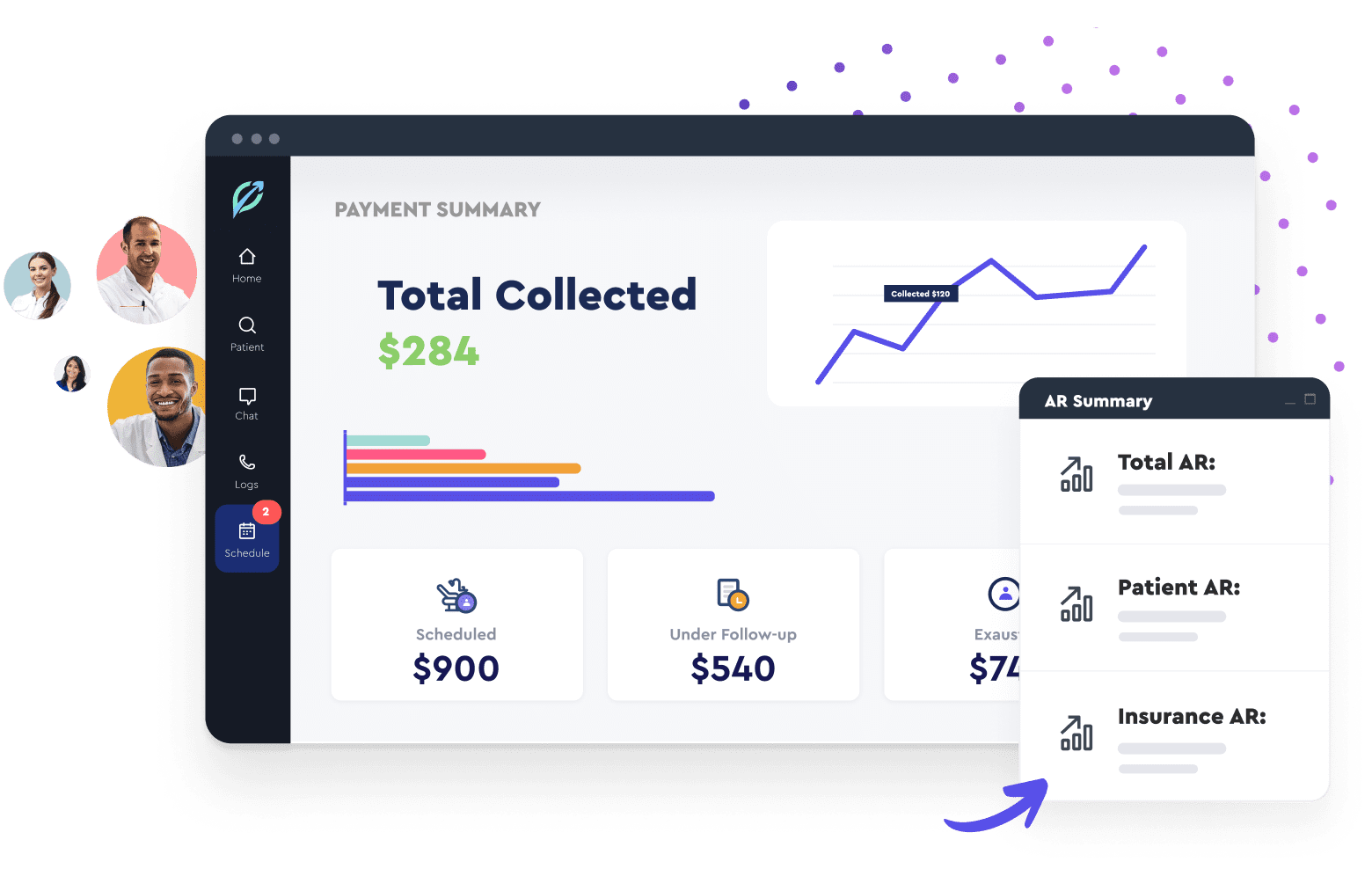

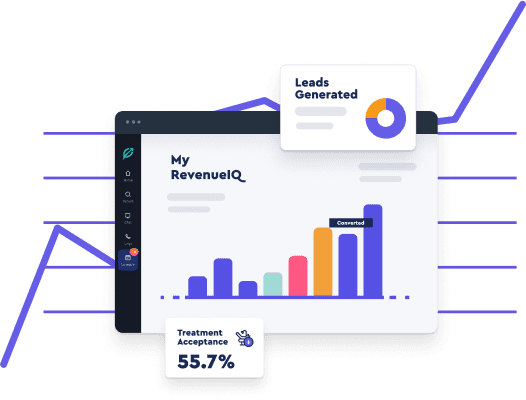

- Analytics

- Practice IQ

Get all the analytics you need to make smart decisions

- Daily Huddle

Start the day on a successful note with just 10 minutes

- Revenue Finder

Find hidden dental practice revenue with one tool

- Goal Management

Create goals that are trackable and attainable for everyone

- Enterprise Dashboard

A single source of truth unified in one dashboard

- Practice IQ

- CRM

- Patient Relationship Management

Enhance communications with your patients

- Patient Follow-Up

An innovative and purposeful way of follow-up with patients

- Reminders

Customizable and automated recall and reminders

- Two-Way Texting

Reach patients in the ways that they prefer most

- Patient Portal

Keep patients in the loop with a user-friendly and modern experience

- Phone IQ

Get smarter insights about how your practice handles calls

- Online Appointment Booking

Syncs with your PMS to read empty slots and write back appointments

- Patient Relationship Management

- Marketing

- Instant Patient Communications

Instant Patient Communications

- Custom Campaigns

Reach patients at the right time with the right message

- Call Tracking

Ensure patients have a seamless interaction with your practice

- Collect & Manage Reviews

We help you gain 5-star reviews for your practice

- Webchat

A seamless way to communicate with your patients

- Marketing ROI

Easily review all your marketing efforts to make smarter decisions

- Online Appointment Booking

Syncs with your PMS to read empty slots and write back appointments

- Instant Patient Communications

- Operations

- PbN AI

Powering Smarter Dental Practices.

- Insurance Verification

Verify all patients in advance saving time and reducing daniels

- PbN Voice

A better call experience for you and your patients

- Patient Forms

Save time on your patient intake process with our digital forms

- Kiosk

Replace the manual check-in process with easy self check-ins

- Patient Flow

Scheduling, record management, and streamlined communications

- TeamChat

Simplify dental office communication with a cutting-edge chat system

- PbN AI

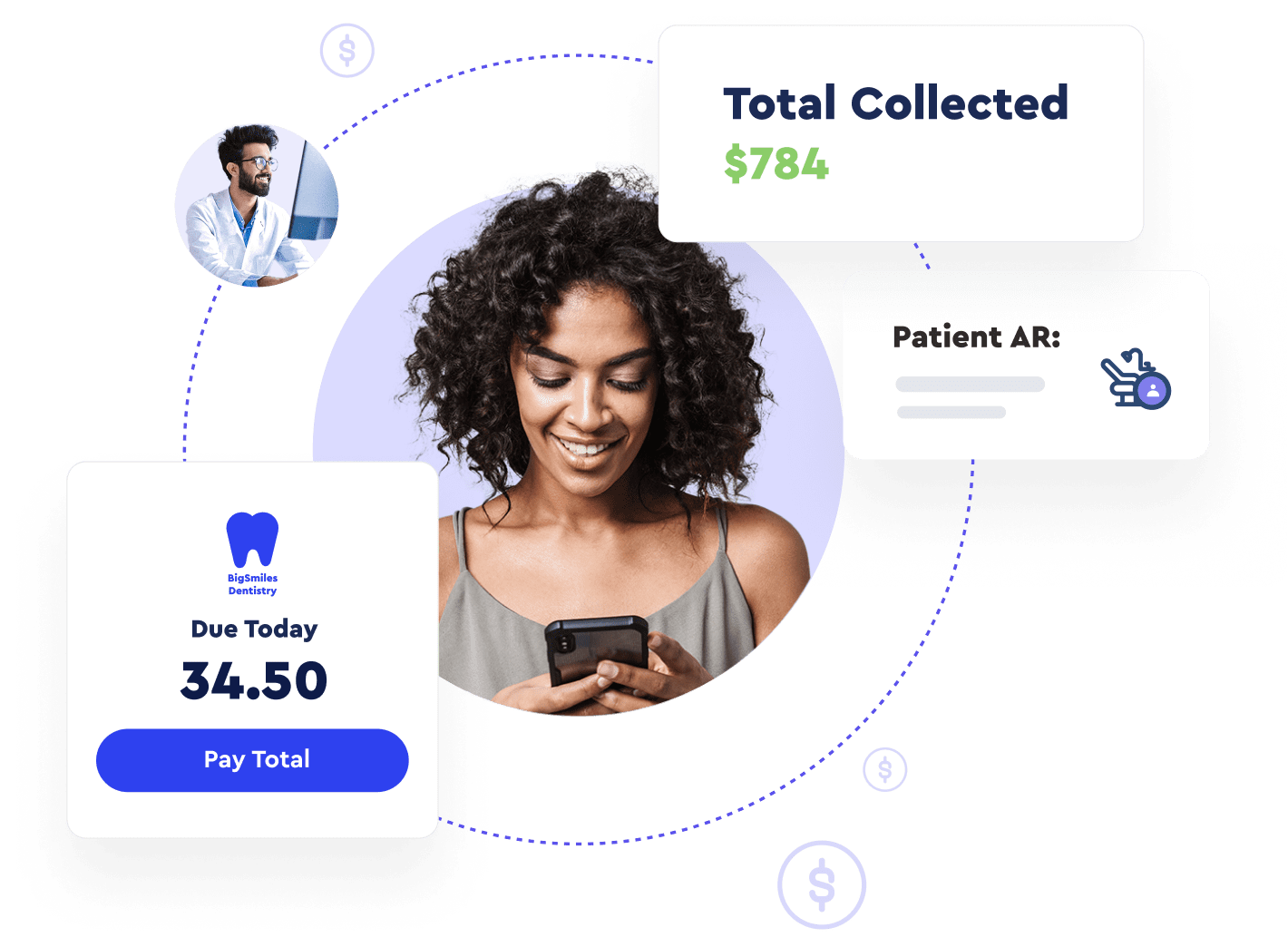

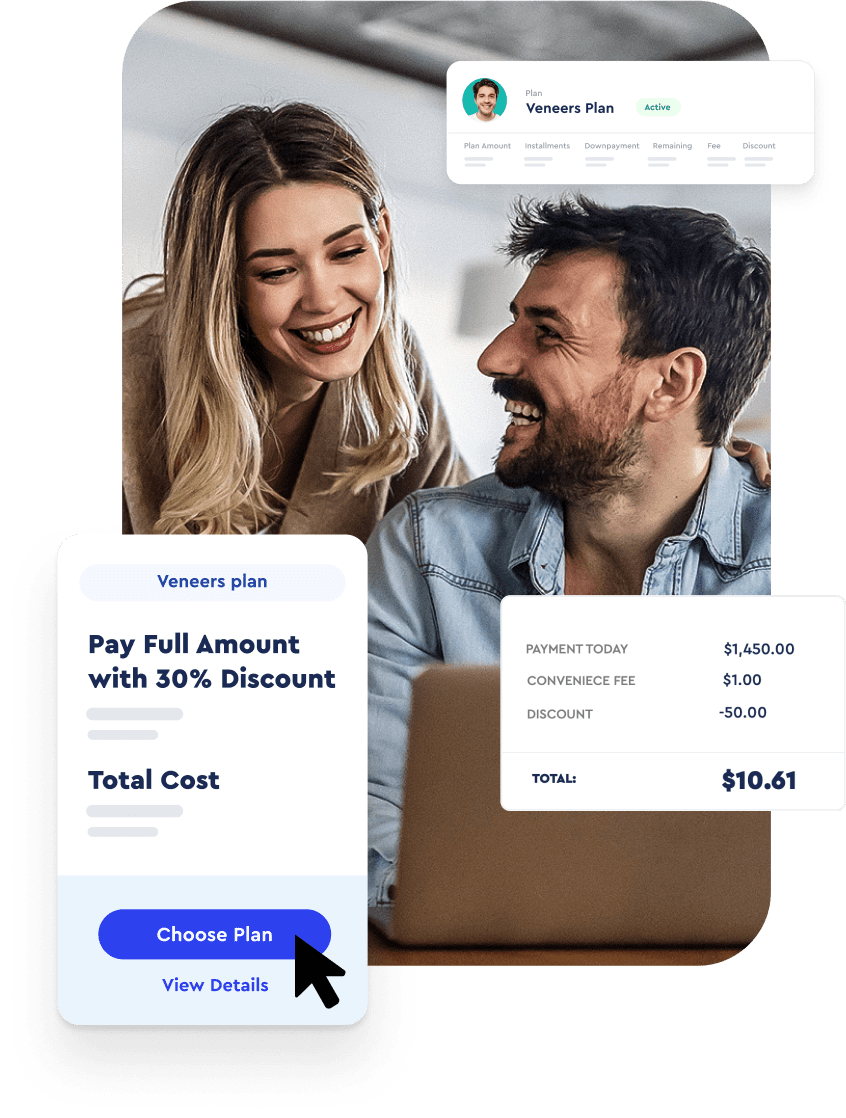

- Payments

- Analytics

- Use Cases

Single Practices

A single source for your marketing, analytics, payments, VOIP, and recall/reminder needs

Marketing Agencies

See how campaigns are performing and deliver accurate and reliable results to your clients

Multiple Practices

Whether you have 3 offices or 300, you’re in good hands

Pricing

Delight your patients and manage all aspects of your practice

Dental Consultants

Consultants prefer our one-stop all-encompassing solution

Request a Demo

Consolidate your software into a single solution and cut your software bill by up to 60%

CPAs

Build longer-lasting, loyal relationships by adding even greater value to your clients

- Company

About Us

We’re passionate about crafting user-friendly software solutions that streamline operations

Core Values

We are dedicated to empowering dental professionals to transform their practices

Our People

Meet our growing team of fully remote evangelists that span the globe from North America to India.

Careers

We’re always looking for passionate people to join PBN

Partner

Refer practices to our platform and earn revenue share on any resulting sales.

- Compare

- PBN vs Weave

Still weighing your options? Take a look at the comparisons

- PBN vs Dental Intel

Our robust analytics track over 600+ KPIs from your PMS

- PBN vs Yapi

We make it easy to get up and running in as little as 1 day

- PBN vs Nexhealth

Practice by Numbers is the better choice

- PBN vs Flex Dental

We streamline your office and consolidate all your software

- PBN vs Solution Reach

We’re a single source of truth for your practice analytics

- PBN vs Revenuewell

Consultants prefer our one-stop all-encompassing solution

- PBN vs Adit

Our mission is to revolutionize dental practice management

- PBN vs Lighthouse 360

Streamline your office and ensure the best patient experience

- PBN vs Weave

- Resources

- Pricing