From Delays to Efficiency: Decreasing Average AR Days for Smooth Collections

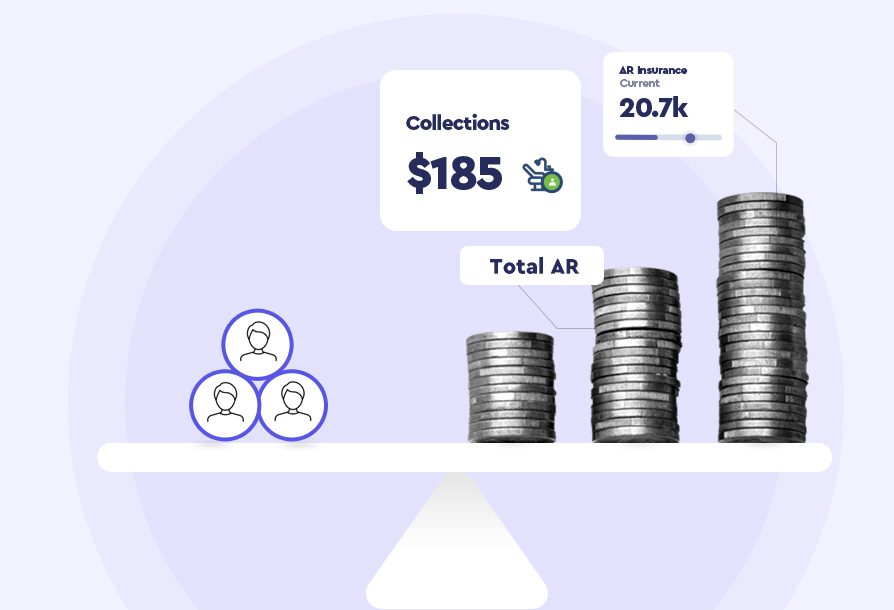

As a dentist, managing your practice’s finances is crucial for the success and longevity of your business. One of the most important metrics to track is your Average AR Days. This number represents the average amount of time it takes for your practice to collect payment from patients and insurance providers. The longer your Average AR Days, the more your practice’s cash flow and profitability are negatively impacted. In this blog post, we will explore how to decrease your Average AR Days and master collections.

Understanding Average AR Days

There’s always room for growth in any business, and dental practices are no exception. But without the right data, it’s hard to pinpoint exactly where improvements need to be made. Data analytics can give valuable insights into

Average AR Days, or Average Accounts Receivable Days, is a financial metric that measures the average amount of time it takes for your practice to receive payment from patients and insurance providers. It is calculated by dividing the total accounts receivable by the average daily charges. For example, if your total accounts receivable is $100,000 and your average daily charges are $10,000, your Average AR Days would be 10.

This number provides insights into your practice’s production, patients’ payment behavior, the effectiveness of your collections process, patient satisfaction, issues with insurance providers, and more.

In a dental office, the ideal average accounts receivable (AR) days number can vary, but typically a lower number is preferred. Dental offices, like other healthcare providers, often bill insurance companies and patients for services rendered, and the collection process can sometimes take time.

While there is no universally defined ideal average AR days number for dental offices, a range of 30 to 45 days is often considered reasonable. This means that, on average, it takes 30 to 45 days for the dental office to collect payments from insurance companies or patients after providing the services.

It’s important to note that dental offices may have different payment terms and collection processes, and factors like the type of dental procedures performed, insurance billing practices, and patient demographics can affect the average AR days number. Therefore, it is advisable for dental offices to establish their own benchmarks based on industry standards and their specific circumstances, and then monitor and manage their AR effectively to ensure a healthy cash flow.

Average AR Days, or Average Accounts Receivable Days, is a financial metric that measures the average amount of time it takes for your practice to receive payment from patients and insurance providers.

Importance of Tracking Average AR Days

Tracking Average AR Days is vital for several reasons:

- Production Analysis: It reveals the amount of production your practice has generated within a specific time frame. By monitoring this metric, you can gauge your practice’s performance and identify any variations or trends.

- Payment Efficiency: Average AR Days shows how quickly patients are paying their bills. A shorter average indicates a more efficient collections process, which can positively impact your cash flow and financial stability.

- Collections Process Evaluation: By tracking Average AR Days, you can assess the effectiveness of your collections process. If the number is consistently high, it may indicate the need for improvements or adjustments to your procedures.

- Patient Satisfaction: The state of patient satisfaction can be reflected in Average AR Days. Prompt payment may indicate contented patients, while longer payment delays could imply dissatisfaction or issues with billing clarity.

- Insurance Provider Issues: Monitoring Average AR Days can help identify any challenges with specific insurance providers. If payment delays are primarily associated with a particular provider, it may necessitate further investigation or negotiations to address the issue.

Collection Percentage

Claims Aging is another way that paying attention to your average AR Days helps your practice. Claims Aging refers to the length of time it takes for your practice to collect payment for outstanding insurance claims.

Tracking Claims Aging is important because it helps you identify areas where your practice’s billing and collections processes may need improvement. Additionally, it can help you identify any trends or issues with specific insurance providers.

Claims Aging can be difficult to track with practice management software due to the complexities involved in accurately tracking and managing insurance claims. It is important to have a system in place to track Claims Aging and to regularly review this data to identify any areas that need improvement.

Strategies to Reduce Average AR Days

- Streamline billing and collections. This includes setting up automated payment reminders, offering online payment options, and regularly reviewing and updating your billing policies and procedures to ensure they are efficient and minimize any delays or errors in submitting claims.

- Improve front-end processes. Enhance your registration and verification procedures to gather accurate and complete patient information, including insurance details, upfront. This helps avoid delays in claim processing.

- Implement clear billing and payment policies. Provide patients with regular updates on the status of their outstanding balances; ensure they understand their financial responsibilities, payment options, and due dates.

- Monitor and address insurance claim denials. Identify any trends or issues with insurance providers and take proactive steps to address these issues.

- Implement a system for tracking and reviewing your Average AR Days and other financial metrics regularly.

By implementing these strategies, you can decrease your Average AR Days and improve your practice’s financial health. Remember, tracking your financial metrics is crucial for the success of your practice, and regular reviews and adjustments can help ensure your practice’s long-term viability.

Ready to get started?

To learn more about prioritizing your patients experience, reach out to us for a demo today.