Practice by Numbers has allowed us to collect on outstanding accounts with a few clicks!

– Avondale Smiles

You have a modern office. You are paperless for the most part. Why are you still sending paper statements? Ditch the printer, stamps and say bye bye to paper cuts. PbN will modernize your whole Accounts Receivables process reducing waste and improving your patient experience better.

Paperless workflow for your Accounts Receivables.

Allow our system to identify patients who need to be followed up with for their pending balance

Follow-up on pending balances with patients with friendly text and email notifications to prompt payment.

Allow patients to easily pay on any device within a few clicks.

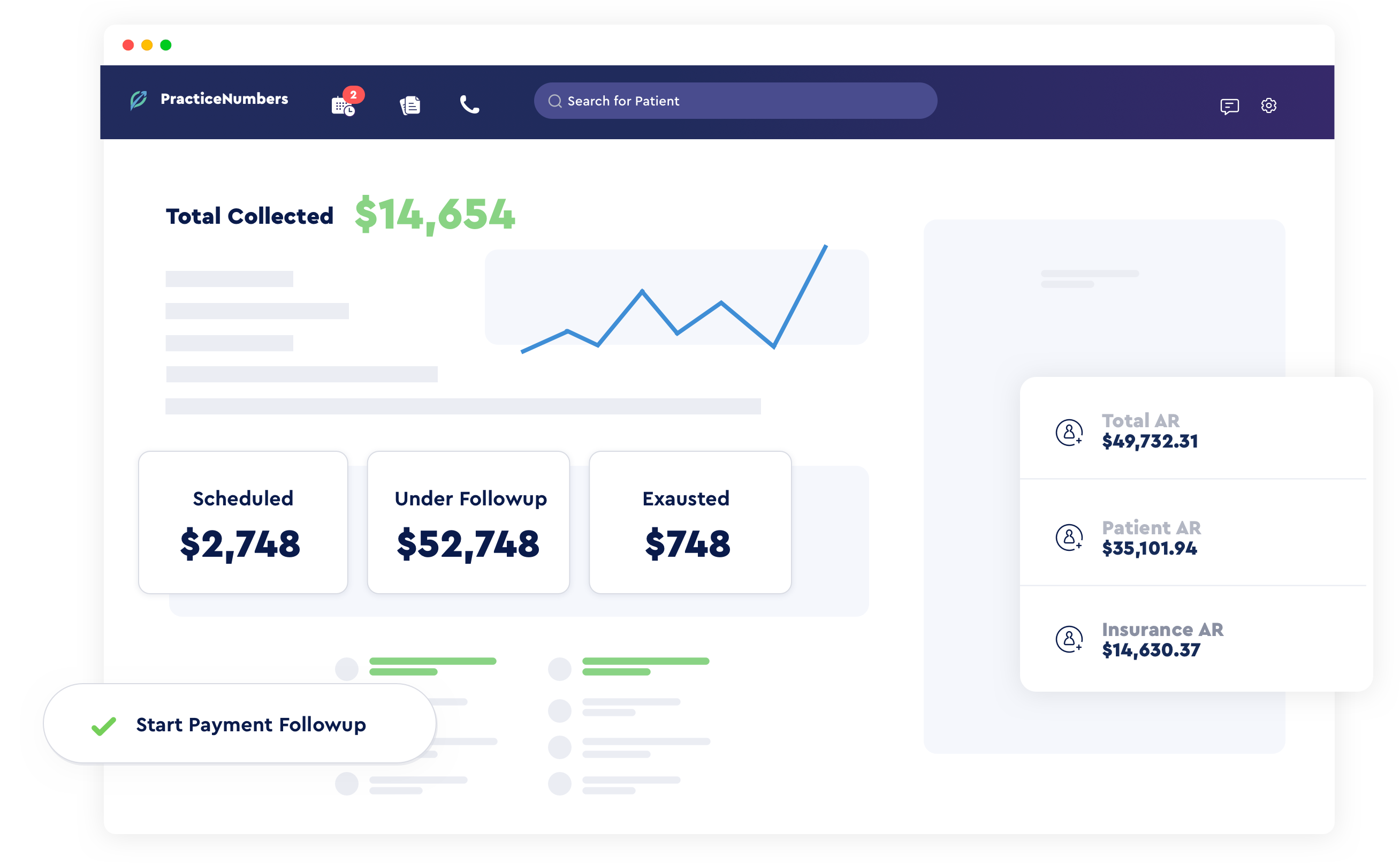

Patient balances are pulled directly from your PMS. All payments are written directly into your PMS with any interaction from your staff.

PbN removes the need for running, printing, folding and mailing statements every month.

PBN’s follow-ups engine sends patients messages at the right time over multiple channels to get their attention.

PbN Payments is an included feature within our PracticeIQ bundle. You don’t need to pay anything extra to have access to our AR automation platform if you are already a bundle user.

PbN Payments costs the practices only 1% of payments run through our platform. Your patients are charged a convenience fee which is fixed at 2.9%+30 cents for each transaction. For example, if the patient owes $100, they will be charged $103.30 after including convenience fees. PbN will charge 1% from the net amount of $100 resulting in $99 being transferred to the practice.

We cannot give you legal advice if it is legal to surcharge your patients in your state or not. Please consult with your attorney to see if this feature is right for you. https://www.merchantmaverick.com/credit-card-surcharges/

It is getting more and more accepted for credit card fees are being charged to consumers. It is after all these consumers who are asking for more and more rewards from the credit card companies which is in return driving up credit card fees. We recommend you ask these patients to mail in their payments or stop by the office.

No, not at this point. We are looking into integrating more credit card processors and this will become an option in the future.

PbN will transfer funds to your practice account using ACH. By default, all practices are set up to receive payments in 2 business days.

PbN will allow you to add 10 automated follow-ups. After these follow-ups are complete, you will have to option of restarting the follow-ups or sending a one-time collections follow-up.

Yes, you can customize the message of each follow-up. By default, all follow-ups will have the same message but you can customize them as needed for your practice’s workflow.

Yes, PbN will automatically post all patient’s payments to their ledger. If payment sync fails for any reason, PbN will alert you in the action center about a failed payment sync. PbN has to-way integrations with Dentrix (G7.2 and higher), OpenDental (20 and higher), and Eaglesoft (17 and higher).

Yes, PbN will keep copies of all SMS and email communications sent to the patient regarding their outstanding balance.